About FOI

.jpg)

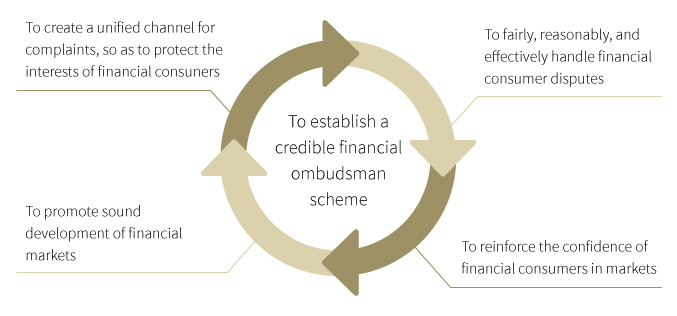

The Government enacted the Financial Consumer Protection Act (FCPA) in 2011 to protect the interests of financial consumers and to fairly, reasonably, and effectively handle financial consumer disputes, thereby reinforcing the confidence of financial consumers in markets and promoting sound development of financial markets. The FCPA was effective on 30 December 2011.

The Financial Ombudsman Institution (FOI) is established under the provisions of Chapter III and Article 13 of the FCPA as a scheme incorporated foundation to fairly, reasonably, and effectively resolve disputes between financial consumer and financial services enterprise. The FOI is totally funded by the government with NTD 1 billion (€25,000,000) and governed by the Financial Supervisory Commission (FSC). It formally began operating on 2 January 2012. All the services that the FOI provides to financial consumers are free of charge.

Missions of the FOI

- Providing advisory services related to financial consumer disputes.

- Assisting financial services enterprises in filing complaints.

- Mediating disputes between financial consumers and financial services enterprises.

- Conducting ombudsman procedures in financial consumer disputes.

- Conducting education and awareness programs for financial services enterprises and consumers.

- Handling custody and utilization of the fund.

- Handling matters on behalf of the competent authority.

- Handling other matters helpful to achieving the goals of the FCPA.

What Does FOI Aim For?

4Debug ControlName DetailCommon